With more than $100 billion in annual revenues and nearly $15 billion in operating profits, Verizon is a large and prosperous company that should pay a substantial amount in taxes to federal, state and local governments.

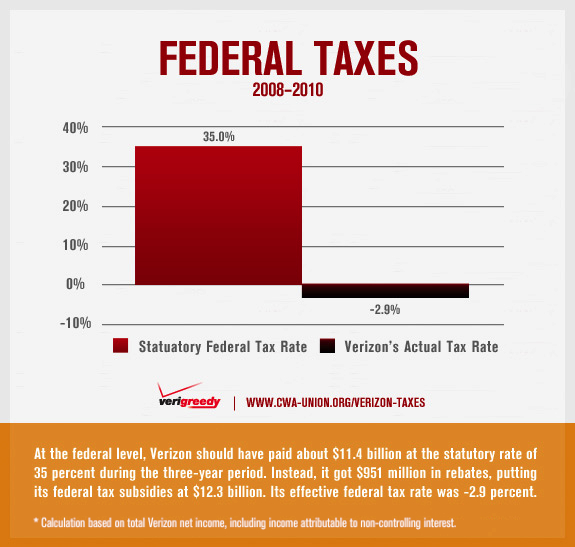

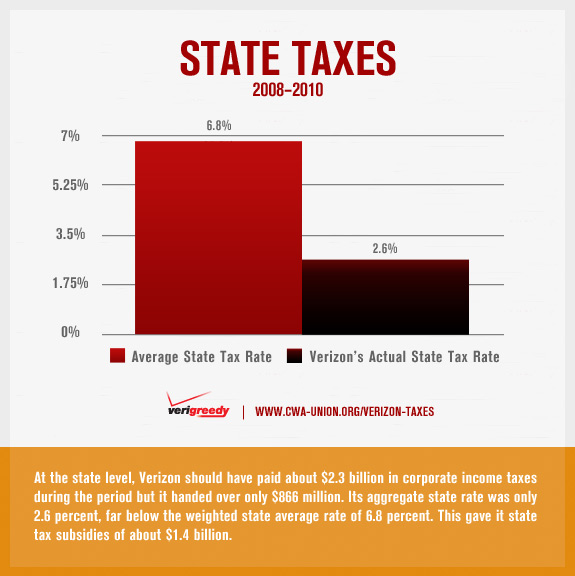

However, Verizon has found ways to get around its obligations and pay dramatically less than it should. At the federal level it uses tax avoidance techniques to bring its income tax rate down to a negative level -- meaning that it receives rebate payments from the Treasury. At the state and local levels, Verizon and its subsidiary Verizon Wireless have frequently received economic development subsidies and challenged the assessed value of their facilities in order to lower property tax payments.

All in all, Verizon is one of the country’s most aggressive corporate tax dodgers. Check out the infographics below, or read the full report at right.