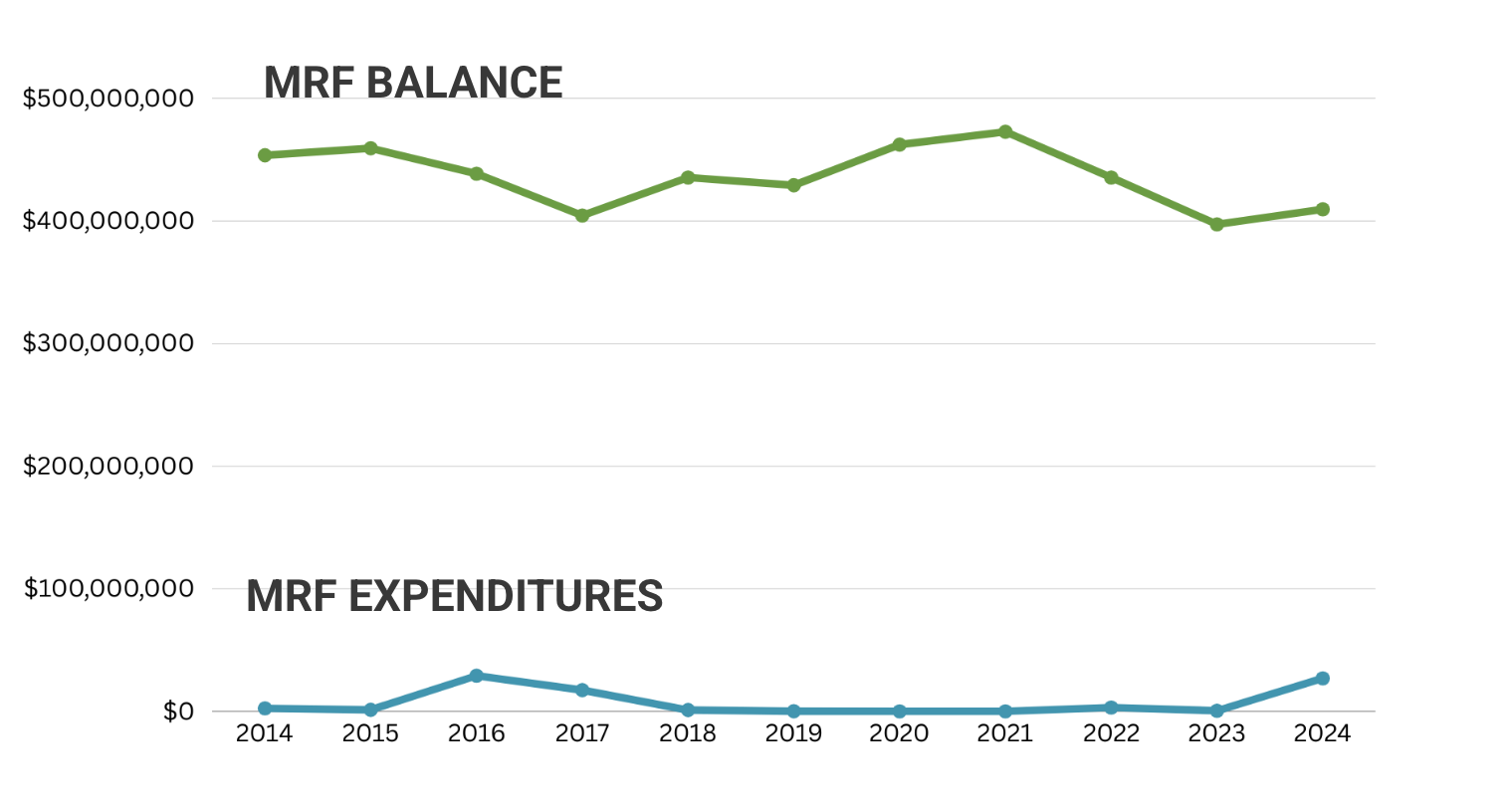

Members’ Relief Fund Balance and Expenditures

Over the past decade, our annual Members’ Relief Fund expenditures have been just a small portion of the total available in the MRF.

Our Members’ Relief Fund balance has fluctuated between $400 million and $473 million. These fluctuations are driven by payments toward CWA strike actions and the ups and downs of the market.

The trend in the MRF over the last 10 years has shown that we have been able to fund our Strategic Industry and Growth Fund programs while also maintaining a significant Members’ Relief Fund reserve that supports significant strike action. In 2016 and 2017 the strike fund paid out $42 million in benefits to 36,500 Verizon strikers and in 2024 the strike fund paid $25 million to 17,000 strikers at AT&T Southeast in addition to benefits to other striking workers.

CWA Unbreakable Resolution Passes Financial Stress Test

To set the new Members’ Relief Fund floor levels proposed in the CWA Unbreakable Resolution, the CWA Executive Board evaluated the amounts against potential stressors on the Members’ Relief Fund under the following conditions, both with and without the proposed improvement in strike benefits:

- A 5-year strike ready scenario under which our largest unit in bargaining each year engages in a 4 week strike action in addition to our average historical strike expenditures. Those costs total $95 million.

- $100 million in illiquid assets not readily available for strike benefits

- A $60 million decline in assets from a market downturn

Even under these conditions, the Members’ Relief Fund remains well above the level needed to protect our members in bargaining. CWA’s independent financial consultants reviewed and verified these calculations.

| No Change in Strike Benefit | $100/wk Improvement in Strike Benefits | |

| 5-Year Strike Ready Scenario Strike Projection | $95.0M | $115.6M |

| Illiquid "Foundation" MRF Assets | $100.0M | $100.0M |

| Decline in assets from market downturn | $60.0M | $60.0M |

| Members Relief Fund Floor Needed to Cover Stressors | $255.0M | $275.6M |